Bedding Insights

Exploring the latest trends and tips in bedding and sleep comfort.

Digital Asset Trading: The Treasure Hunt for Tomorrow's Millionaires

Uncover the secrets of digital asset trading and embark on a treasure hunt to become tomorrow's millionaire—your wealth-building adventure starts here!

Understanding Digital Asset Trading: A Beginner's Guide to Building Wealth

Understanding Digital Asset Trading has become increasingly vital for beginners looking to build their wealth in a digital economy. Digital asset trading refers to the buying and selling of assets such as cryptocurrencies, tokens, and blockchain-based commodities. To get started, it's essential to understand key concepts such as blockchains, wallets, and the role of exchanges. Once you grasp these elements, you can begin exploring various trading strategies like day trading, swing trading, or long-term investing. Each strategy has its own risk profile and potential for returns, making it crucial to assess your personal goals and risk tolerance before diving in.

As a beginner, you should also educate yourself about market trends and analysis techniques. A solid foundation in technical analysis can help you identify profitable trading opportunities by analyzing price patterns and indicators. Additionally, staying updated on market news and sentiment can provide insights into future price movements. Remember, digital asset trading is not just about making quick profits; it's about building a sustainable strategy that aligns with your financial goals. Start with small investments and gradually expand your portfolio as you gain experience and knowledge in this exciting domain.

Counter-Strike is a highly competitive first-person shooter game that has captivated players since its inception. Players can choose between two teams, terrorists and counter-terrorists, and engage in various objective-based gameplay. For players looking to enhance their experience, using a daddyskins promo code can provide exciting in-game rewards and skins, adding a unique flair to their gaming profile.

The Future of Digital Assets: Trends and Predictions for Aspiring Millionaires

The future of digital assets holds immense potential for aspiring millionaires, with several key trends likely to shape the landscape. One such trend is the increase in decentralized finance (DeFi), which is revolutionizing traditional financial systems by eliminating intermediaries. As DeFi protocols become more sophisticated, they offer unique opportunities for investment, savings, and lending, all while enabling greater access to financial services across the globe. Additionally, non-fungible tokens (NFTs) have emerged as a significant asset class, allowing creators and investors to monetize digital art, music, and collectibles in unprecedented ways. This shift not only creates new revenue streams but also challenges the conventional concepts of ownership and value.

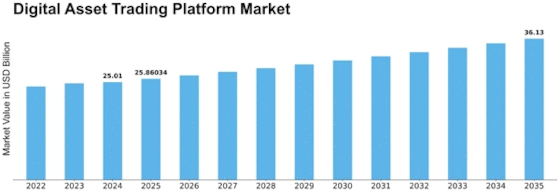

Moreover, the integration of blockchain technology into various industries is a trend worth watching. Industries such as supply chain management, healthcare, and real estate are beginning to utilize blockchain to improve transparency, security, and efficiency. As more sectors adopt this technology, the demand for digital assets is expected to grow exponentially. Furthermore, aspiring millionaires should pay attention to regulatory developments, as governments worldwide work to define their stance on digital currencies. Being informed about these changes can position investors to capitalize on emerging trends and navigate potential challenges in the evolving digital asset landscape.

What You Need to Know Before Starting Your Journey in Digital Asset Trading

Before embarking on your journey in digital asset trading, it's crucial to understand the landscape you'll be navigating. The first step involves gaining a solid grasp of the different types of digital assets available, which can include cryptocurrencies like Bitcoin and Ethereum, as well as non-fungible tokens (NFTs) and other blockchain-based assets. Familiarize yourself with key concepts such as market capitalization, trading volume, and liquidity. Additionally, take the time to research the platforms where you can buy and sell these assets, as choosing a reputable exchange is vital for safeguarding your investments.

Equally important is developing a well-defined trading strategy. This should encompass your risk tolerance, investment goals, and the time you can commit to trading. Some traders prefer short-term gains through day trading, while others may opt for a long-term investment approach. Regardless of your strategy, consider setting up price alerts and utilizing tools for technical analysis to better inform your decisions. Finally, remember to stay informed about market trends and regulatory changes, as the digital asset space is constantly evolving. Knowledge and adaptability will be your greatest allies in achieving success in trading.